[Reading Time: 7 minutes]

(Or as hard-core Bitcoiners want it, I should say.)

“U.S. crypto-preneurs who don’t factor in regulation could under-budget their ventures by, at a minimum, a quarter of a million dollars annually.”

Rocky week for the crypto-currency world this past one! All of the following happened over the course of the last seven to ten days:

- Liberty Reserve (LR) was shut down, and its management indicted and arrested, in what is being described as “the largest money laundering case in U.S. history.” A short video at the bottom explains how the case went down.

- FinCEN designated LR as entity “of primary money laundering concern,” and proposed a rule to order that all large financial institutions freeze any and all of LR’s assets.

- A brouhaha ensued, and all kinds of speculations were made about the future of Bitcoin and all virtual currencies.

- OKPay suspended processing for all Bitcoin exchanges, including Mt. Gox.

- FinCEN Director Shasky Calvery spoke out and drew the line even deeper in the sand –“We stand by the guidance.”

- Mt. Gox hardened its interface by incorporating customer verification.

- Phew!

The events of the past few weeks have marked a turning point in the history of Bitcoin product design. It’s unmistakably clear at this point that:

- Bitcoin can no longer be anonymous.

- U.S. regulation can no longer be ignored.

- Substance has to accompany form.

This is the reason for my title –Bitcoin as every hard-core, idealist libertarian ever dreamed it is over.

Great Innovation Comes with Great Responsibility

Crypto-preneurs need to solve for three variables on which the LR case, just as the E-Gold case of years back does too, offers glaring lessons. The quotes below are taken directly from the indictment:

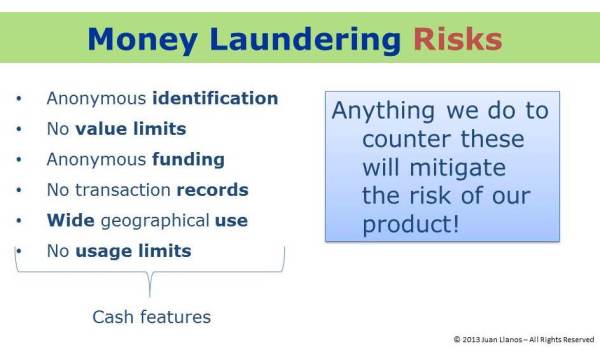

[x] ANONYMITY. They need to successfully address the vulnerabilities on the left-hand side of the graph below. The product has to dissuade the bad element, never attract it.

- “deliberately attracting, and maintaining a customer base of criminals by making financial activity on LR anonymous and untraceable.”

- “designed so that criminals could effect financial transactions under multiple layers of anonymity and thereby avoid apprehension by law enforcement.”

[y] COMPLIANCE. They need to make sure that their product and operations are not in violation of any applicable laws and regulations (the “form” or “paper” side of compliance).

- “was not registered as a money transmitting business with FinCEN”

- “operated an unlicensed money transmitting business.”

[z] SUBSTANCE. They need to make sure that what is written in their policy is actually implemented, that they have operationalized any procedures and controls. And, at the risk of stating the obvious, they need to run their businesses with integrity, responsibility and control (the “substance” part of compliance).

- “intentionally creating, structuring, and operating LR as a criminal business venture, one designed to help criminals conduct illegal transactions and launder the proceeds of their crimes.”

- “lying to anti-money laundering authorities in Costa Rica, pretending to shut down LR after learning the company was being investigated by US law enforcement (only to continue operating the business through a set of shell companies)”

- “created a system to feign compliance with anti-money laundering procedures, […] including a ‘fake’ portal that was manipulated to hide data that LR did not want regulators to see.”

Notice that the Compliance part is the easiest one. As I explained at length in my April 14 post, registering with FinCEN is the least (and cheapest) of the compliance obligations ALL bitcoin exchangers and administrators (including FOREIGN ones servicing US citizens) must implement. Misunderstanding this could have two serious consequences:

a) under-budgeting a crypto-venture by a quarter of a million annually (at a minimum), and

b) exposing the venture to the vulnerabilities that got LR and E-Gold into trouble.

A War Against Bitcoin?

No, I don’t think so. I completely agree with Matt Harris, Managing Director of Bain Capital Ventures, that this has nothing to do with Bitcoin, the alternative currency and its purported threat to the hegemony of the U.S. Dollar. It will definitely have an effect on how Bitcoin entrepreneurs design their product going forward, but it is not (this time around) an attack on the currency itself.

This is all about financial crime. It’s the US Leviathan’s never-ending war against crime. Only this time it’s a financial war waged partially in cyber-space.

Liberty Reserve, described in the indictment as “a financial hub of the cyber-crime world” and “the bank of choice for the criminal underworld,” is obviously an edge case, an outlier. It reminds me of the BCCI case of the late nineties, but this time in the virtual world.

As we can see from the quotes from the indictment above, the alleged criminal activities are reminiscent of organized crime and, if proven, would make Mr. Budovsky and his partners deserving of a place in the Eighth Circle of Dante’s Inferno.

“We Stand By the Guidance”

I’d like to end with a few quotes from FinCEN Director Jennifer Shasky Calvery which highlight what we’ve talked about today:

- “Digital currencies are just a financial service and those who deal in them are a financial institution.”

- “Any financial institution and any financial service could potentially pose an AML [anti-money laundering] threat. It depends on whether folks have the controls in place to deal with those money laundering threats and that they are meeting their AML reporting obligations.”

- “[Virtual currencies are a] part of the financial framework as any other type of financial institution and it has the same obligations as those financial institutions, the same obligations as any money services business out there. For those that choose to act outside of those obligations and outside of the law, they are going to have to account for that.”

- “[Our guidance] is more of a technical guidance on something that already exists.”

- “I think innovation in financial services industry holds out great promise on so many levels for commerce and for social reasons like providing services to the unbanked. But like any financial services, it comes with an obligation and those obligations to protect the U.S. financial system from money laundering need to be taken seriously.”

Finale

In a sense, anonymity is to Bitcoin what copyright infringement was to Napster –the Achilles’ heel that can’t be left unsolved for. Has someone written about the parallels between these two? Interesting topic…

All I have left to say is that IT’S HAPPENING. What I said in early March that would, I mean –“…[that] federal and state regulators and law enforcement agencies might be cooking up cases for regulatory action or even prosecution.”

When faced with what we can’t control, let’s just make the best of it! We would be hard pressed to argue against the value of knowing our customer, right? So, JDI (just do it)! This is a golden opportunity to build a clean and thick customer database from day one.

Let’s JDI!

[QUICK ANNOUNCEMENT: Starting today, I’ll be publishing a “CRYPTO-TIMELINE” on the first day of every month. The title is self-explanatory –I plan to include all relevant events in Bitcoin’s journey to maturity with links to trusted sources.]

Great article on the regulation and compliance aspects of Bitcoin in western countries such as the US. However, I would argue that certain cases will be more conducive to Bitcoin e.g. countries experiencing loss of purchasing power (Argentina), countries with high capital controls, countries where ownership of phones is more prevalent than access to a bank account (e.g. countries in Africa).

Also, I foresee that eventually there will be individuals who “close the loop” and get paid directly in Bitcoin, and purchase goods/services directly in Bitcoin. Regulation against this type of behaviour is more or less impossible.

Posted by Stephan Livera | 2013/06/02, 10:12 amCan we not dispense with the scary headlines that frame all these discussions as ‘either-or’? Under Juan’s rubric of LJDI, let’s just relax a little and continue the mundane tasks of improving ‘context-specific-in-addition-to’ solutions. Some will build on nearly anonymous #bitcoin-as-we-love-it-peer-to-peer transactions, others will gateway through fully AML-compliant services.

There are two kinds of ‘Law’ folks. Statutory ‘Thou shalt Not'(s) and Structural ‘Won’t Work That Way'(s). Fincen will continue diligently to enforce the first and enlightened communications software engineers will continue to build the second.

Myriad non-financial applications will appear, based on architectures that are analogous or even isomorphic with the Bitcoin. Open source equivalents of Silent Circle will be released into the commons as disruptively as PGP once was. Some heavy handed political, regulatory or intelligence hack will violate the sanctity of the anonymous electoral ballot at the very root of democracy and the sacrilege will suddenly seem so egregious, even the entranced American population might awaken to its own revolutionary Spring.

The Bitcoin is born. It cannot be unborn. History will plod for a while, typically, but the texts our great-great-grandchildren study in school will celebrate it as a major turning point. Not so much as mere currency per se, but as an archetype, the seed of our common next step.

Posted by Peter Baril | 2013/06/02, 6:10 pmThanks for your interesting PoV, Peter. I don’t disagree with you. I know there’s opportunity for abuse (unwitting or intentional) on the part of the government too. However, there is a reality -society is worse-off when mechanisms that facilitate crime exist. My only hope is that our great-great-grandchildren do have a livable society. Hence my support of reasonable, common-sensical, regulation.

Posted by Juan Llanos | 2013/06/02, 6:21 pmUnderstood Juan. Societies do take steps to protect themselves and their constituent individuals from bullying. Sovereign and personal.

However, my comments stem from and include a recognition that the larger ‘shadow economy’ is not primarily criminal. Its non-criminal components are immense and merely practical, dwarfing any Bitcoin-facilitated criminal sector to the point of .. well being beside the point in practical terms.

The truly immense global shadow economy exists not so much in defiance of the mainstream, but quite simply and for the most part innocently, adjacent to it. Without endorsing or condemning his other frames of reference, I recommend a telling description of its real estate and small business domains in a single city, Cairo, as cited in Hernando de Soto’s book “Mystery of Capital”.

Assertions about the Bitcoin’s criminal use cases are not altogether intellectually respectable only because they are now quantitatively trivial compared to its emerging legitimate uses. They are quantitatively trivial compared to the size of the overall non-criminal shadow economy. Mostly, such assertions utterly miss the principles and promise in human society that are deeply contingent on some reasonable expectation of privacy and anonymity. The democratic principle of a secret ballot is perhaps only the most important such instance. Thwarting unauthorized commercial and criminal access to individual identity comes a close second.

I will, therefore, conclude my contribution to this thread by saying that people sincerely concerned with safety, legality and the effects of anonymity in the Bitcoin need, at a minimum, to become conversant with the ‘claims-based-authentication’ in addition to the Bitcoin.

Together they hint at the emerging new Architecture of Consent in democratic society and, in my opinion, a juxtaposition of the two is the minimum criterion for credibility on the subject.

Posted by Peter Baril | 2013/06/03, 12:00 pmVery interesting comments, Peter. I mean it. You’ve given me food for thought.

Posted by Juan Llanos | 2013/06/03, 12:10 pmThis is pure nonsense. Bitcoin itself is completely unaffected by the latest legal threats and actions.

What *are* affected are above-ground Bitcoin businesses taking customer deposits in national currencies and/or providing services that go under money transmitter or exchanger rules.

NOT affected are people making cash-for-Bitcoin swaps in person, people transacting business solely on the Bitcoin block chain, and people and businesses that don’t care a whit about the repressive, innovation-stifling AML/KYC laws around the world — which, dressed up in the guise of “fighting crime”, are really about total financial surveillance to ensure the maximum tax grab for the ruling class and placing crushing burdens on anyone who would dare to compete against the creaky, bloated, diseased, super-privileged, 1%-owned legacy financial system. The latter group operate both above-ground but not yet at a scale to attract the attention of the ruling class’s goon squads as well as completely below ground, be it through the use of PGP encryption and anonymization networks like Tor or I2P or just on a person-to-person or “club” type basis.

Bitcoin itself is a protocol and a shared transaction register. Saying “the end of Bitcoin” is to misunderstand the nature of the thing entirely.

Posted by Mike Gogulski | 2013/06/03, 10:14 amAll I can say, to summarize the discussion we had on a different forum, is that I’m just reporting WHAT IS from the point of view of the U.S. (whether you or I like it or not). If you ask me, I wouldn’t like there to be power asymmetries, excesses and unfairness in this world. However, a nation and world where the law (the dictates enacted by society through republican institutions) rules trumps the alternative, IMHO.

Posted by Juan Llanos | 2013/06/03, 11:00 amHear, hear!

I had to read the post twice because I thought I missed a /sarc switch somewhere or some key context info…

Glad to see I’m not the only one who is puzzled by this post (I wouldn’t call it nonsense, but I would say the “practical” perspective encouraged by the author means one may instead just use US$ and spare himself all the paperwork nonsense!).

The main point of bitcoin is that it is completely unaffected by the legal crap. If you don’t accept that, there’s not much else to bitcoin that’s worth the trouble.

Posted by NK | 2013/07/14, 10:40 amI don’t disagree with you. I have nothing against the creation of capital through securitization. My only point was how usual is it to see a warning that the core asset you’re asking your investors to bet on could become illegal?

Posted by Juan Llanos | 2013/07/14, 11:40 amThis article brings up excellent points regarding U.S. regulation and explains the LR case well, however I find the case only tangentially related to Bitcoin. LR’s shutdown serves as a reminder that the U.S. doesn’t like anonymous transactions, a conclusion that is kind-of unsurprising. I fail to see the “Death of Bitcoin as we know it”, which may be a system that cannot be regulated. Who would be the target of AML suits, the exchanges? The users? The creator? There’s no obvious single-entity enabler to the system, and that’s the point of it bitcoin anyways.

It may be that the U.S. outlaws Bitcoin all together, but that’s an angle with questionable efficacy and one that is irrelevant to the regulatory aspect highlighted here.

Posted by matt | 2013/06/03, 2:50 pmThose are good questions, Matt. I have never in my articles spoken about Bitcoin the currency. I use “Bitcoin” loosely to mean mostly market makers or players at the interface between the fiat currencies and the virtual currency. In the “A War Against Bitcoin?” section of the article, I plainly disagree that the LR case has anything to do with the supposed pursuit of Bitcoin. This is just a criminal case, and a flagrant one at that, if the allegations are proved.

Posted by Juan Llanos | 2013/06/03, 3:07 pmwhat about:

1- satoshi square?

2 – otc transaction in irc channel?

3 – bitcoin mizing service?

4 – ripple (or similar) decentralized exchange that is coming?

Posted by rodomonte | 2013/06/03, 7:56 pmThe FinCEN rule is very clear: “virtual currency exchangers and administrators ARE money transmitters. In the case of Satoshi Square, where it’s end users exchanging value via a platform (in a barter-like fashion), without currency conversion, then it’s the SS administrators who need to comply with US law. Until FinCEN says otherwise (they rarely back up a decision, though), whoever (a) converts currency (is an exchanger), or holds and supports the virtual currency (is an administrator) must comply with registration, reporting, LICENSING (where required), and all other obligations. Regulation is technology-agnostic, it’s the capacity or nature of the activity that defines money transmission. If in doubt, re-read the regulation (and consult a lawyer if you need to make a decision! I don’t provide legal advice). Sorry, I’m just a messenger trying to help.

Posted by Juan Llanos | 2013/06/03, 8:23 pmJuan I really appreciate your perspective in these articles and I am in agreement with you – that it’d be foolhardy indeed to build a crypo-currency startup (esp in the US) without very seriously considering the money laundering issues.

I explained bitcoin to my dad recently and his comment was “…well if one wanted do anything illegal, it sounds like cash is still the best option”.. I’m inclined to agree; with Btc you’re leaving a paper (block transaction) trail which is about as public and irrevocable as it’s possible to get.

So yeah, anyone serious about Btc needs to seriously figure out which side of the law they want to be on.

As we see, the US Govt is neither toothless nor stupid – the wheels grind slowly, but they do grind.

Posted by DrTune | 2013/09/14, 5:16 amThanks for your comment, DrTune. You won’t believe how many crypto-preneurs are STILL skpetical about all this and keep defying the government. The feds have not yet cracked down on any of the big name Bitcoin exchances in the US, but may soon do to teach them a lesson. I certainly hope not, but it’s a possibility.

Posted by Juan Llanos | 2013/09/14, 12:57 pmSpeaking of the Feds; there goes Silk Road!

They’ve been on to him since maybe December according to the charges.

He made several mistakes, I found one clue that seems to have been overlooked;

Here’s “altoid’s” posts on bitcointalk… (which is down right now unfortunately)

https://bitcointalk.org/index.php?action=profile;u=3905;sa=showPosts;start=20

See post #40 (from 2011) , Altoid pasted PHP code for sending BTC from an address, trying to get it to work..

Quote:

“… But when I hard code in the parameters:

$bitcoin->sendfrom(“1″,”1LDNLreKJ6GawBHPgB5yfVLBERi8g3SbQS”, 10);

…”

He’s trying to send BTC so clearly has the keys for that wallet. Look for that address on blockchain and…https://blockchain.info/address/1LDNLreKJ6GawBHPgB5yfVLBERi8g3SbQS

Over $1.1M (current prices) received from…

https://blockchain.info/taint/1LDNLreKJ6GawBHPgB5yfVLBERi8g3SbQS many, many addresses.

Obviously this doesn’t necessarily tie him to SR directly (well it might, didn’t look at the blockchain extensively) but it’s amazingly careless of him to post a wallet address on a forum and then reuse it to receive a fat pile of money.

…if nothing else it would seem highly likely the IRS and/or the Feds are analyzing the blockchain.

Posted by DrTune | 2013/10/04, 4:13 pm