[Reading Time: 5 minutes]

This question or some variation of it has actually been posed to me by many virtual currency enthusiasts over the past few months. It so happens that the financial services regulations applicable to many new virtual currency businesses have been seen as impinging upon the core features that make Bitcoin so innovative and potentially disruptive.

First, the hope for complete anonymity was shattered by the statutory obligation to implement know-your-customer procedures at the currency translation points. Second, the irrevocability of transactions was dampened by the federal consumer obligation to provide for delayed executions, cancellations and refunds. Is financial privacy next?

One of Bitcoin’s most salient and innovative attributes is that its block chain, the public ledger where the entire history of every transaction ever conducted is stored, is publicly viewable by anyone with the right tools. Given this unique window into their virtual currency wallets, are Bitcoin users not at risk of giving up the right to the private use of a currency that cash affords them today? I say at risk because it may still be possible to implement safeguards to prevent that from happening.

An Escape Valve for Anonymity

Today, those of us who enjoy the many privileges of modern life have access to savings, credit and investment accounts. In other words, we are ‘banked’. Arguably, however, once our earnings are deposited into those accounts, they are no longer private, let alone anonymous. Every single cleared employee of every single financial institution that holds an account of ours knows everything about our financial life –how much we earn, how much comes in and goes out of our accounts, what businesses we patronize, what products we buy. So do social platforms where we thoughtlessly divulge much of our private lives. All this data is a treasure trove for marketers and risk personnel interested in, respectively, monetizing that data, and preventing losses and criminal activity.

In using financial intermediaries, we choose to trade off privacy and anonymity for the perceived benefits of security, convenience and the hope that financial institutions and businesses will strive to tailor their offerings to us. What is more, our non-public personal information –in theory, duly protected by federal law, but not demonstrably so– is captured and retained by as many financial institutions as we use, including every single e-commerce site where we have ever shopped.

Notwithstanding this, we still have the choice of using cash –a completely anonymous medium of payment. As inconvenient and old school as cash may be, once it’s in our pockets –off the radar screens of our financial institutions– it gives us complete freedom to buy products and services in a completely anonymous and untraceable way. So much so that we can even use it for illicit or amoral purposes with total impunity. Cash is then, in a sense, an escape valve from the ongoing surveillance that we are constantly subjected to in the modern world. Perhaps that is one reason why a study found that, in spite of the myriad emerging payments innovations, the use of cash is actually growing in the world.

“Bitcoin is Not Anonymous”

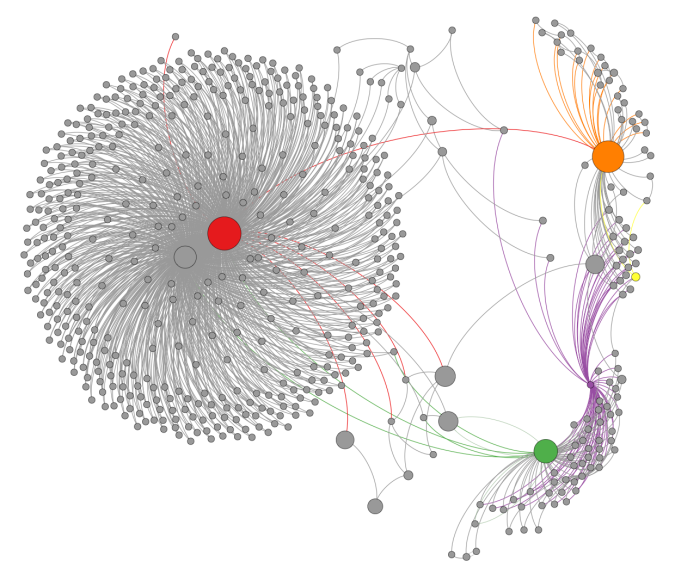

In mid-2011, a pair of young Irish techies conducted what may have been the first documented analysis of Bitcoin’s block chain. This study presents the case of a thief that stole 25,000 Bitcoins in 2011 and shows how all transactions can be traced and linked back to common nodes and addresses. Here is a visual representation of the thief’s digital wallet and its link to other sources and destinations:

The study concludes that a passive analysis of Bitcoin’s public ledger allowed them to “de-anonymize considerable portions of the Bitcoin network”:

“Using an appropriate network representation, it is possible to associate many public-keys with each other, and with external identifying information. […] Large centralized services such as the exchanges and wallet services are capable of identifying and tracking considerable portions of user activity.”

Further studies have been conducted that support this conclusion, and data mining services exploiting the public access to Bitcoin’s block chain are beginning to emerge.

A Boon to the Surveillance State?

The fact that Bitcoin is actually a very open, transparent system clearly contrasts with the claim that “bitcoins are invisible to law enforcement and that taxman.” On the contrary, the open nature of Bitcoin’s block chain could actually be a boon to law enforcement and the taxman.

This brings us back to the title question, an affirmative answer to which is, short of its outright censorship, the virtual currency entrepreneurs’ biggest fear. It appears as though the idealistic hopes of hardcore virtual currency supporters that Bitcoin would create a parallel, a-political universe may be caving in to the reality that the current public policy, and the lagging laws and regulations that implement it, demand a heightened degree of invasiveness and control. And the latter, perplexingly enough, can be facilitated by the open protocol itself.

The potential for use (and also abuse) of the open access to the block chain by both private and public actors is real. Someone joked the other day that the mouths of the advocates of Total Information Awareness must be watering at the possibility to access the entire history of Bitcon transactions. Paradoxically, a disruptive technology that is facing enormous regulatory challenges may actually be in need of some form of regulatory safeguard to protect the privacy of its users. It would seem as though virtual currencies will be needing the state more –and for different reasons– than initially thought.

The key to mitigating this systemic risk to the Bitcoin platform posed by over (and now under?) regulation will be to clearly differentiate Bitcoin’s multiple facets –as a currency, as an asset, as a commodity, as a medium of payment, as a platform, as a protocol–, and to maintain an open dialogue with policy makers and the government, which has already begun to happen. Seeking the opinion of the public at large would not hurt either.

[This post was inspired by Marc Hochstein’s February 11, 2013 American Banker’s article “Why Some Payments Should Remain Anonymous”.

I invite those less familiar with the regulatory developments in the United States to visit my Virtual Currencies section for in-depth analyses of the most recent cases, or to search the web for related news.]

________________________________________

2013-08-30 UPDATE: On the same day as this post, a very interesting and relevant research paper by a group of students led by Sarah Meiklejohn, a PhD candidate in Computer Science at University of California, San Diego was published. The paper is titled “A Fistful of Bitcoins: Characterizing Payments Among Men with No Names”, and its conclusions are not dissimilar to the ones reached by Fergal Reid and Martin Harrigan in their 2011 study:

- the demonstrated centrality of these services makes it difficult for even highly motivated individuals— e.g., thieves or others attracted to the anonymity properties of Bitcoin—to stay completely anonymous, provided they are interested in cashing out by converting to fiat money (or even other virtual currencies).

- the increasing dominance of a small number of Bitcoin institutions (most notably services that perform currency exchange), coupled with the public nature of transactions and our ability to label monetary flows to major institutions, ultimately makes Bitcoin unattractive today for high-volume illicit use such as money laundering.

- a well and fairly regulated virtual currency industry makes it exceedingly difficult for bad actors to use the system for illicit activities.

Here are links to Sarah’s full paper and slides.

Discussion

No comments yet.